Asset Protection Law Firm Shares an Asset Protection Strategy

What is Asset Protection?

It’s a legal process within the realm of estate planning that protects your wealth (property, financial accounts, private capital, businesses, investments, etc.) through arrangements that structure assets in a way that makes it very difficult for a creditor to collect. The goals of asset protection planning are not to be deceitful and secretive, hide assets, or defraud creditors. Instead, asset protection planning strives to improve a client’s position in bargaining and negotiations while deterring litigation and furnishing legal options. In most circumstances, it’s never too late to engage in planning an asset protection strategy. Anyone who’s been diligent and fortunate enough to accumulate assets needs some form of asset protection. Spiegel & Utrera, P.A.’s Asset Protection Law Firm brings you 175 years of experience in asset protection, estate planning, and entity formations to cover all your bases and help ensure the longevity of your wealth.

Call (800) 603-3900 for a Free Consultation with our Asset Protection Law Firm

How to Protect Your Assets from Judgments

The most common type of asset protection planning is the purchase of liability insurance—such as automobile, homeowners, or malpractice insurance—but can be unreliable due to inadequate coverage and extensive policy omissions. Many states allow residents to exempt particular assets from the claims of creditors but are subject to specific limitations, such as a threshold for the value of an asset to qualify for protection. Creating a business entity (like an LLC or a Corporation) is another common form of asset protection, allowing for limited liability and the power to segregate the business assets from the personal. Some business entities are a better fit than others to protect your assets and their effectiveness in doing so depend on the context of your particular situation.

Asset protection planning is a complex legal matter that benefits greatly from expertise in estate planning, business law, and entity formation. Lack of mastery in any one relevant area of law might prevent a client from getting the best possible results, which is why you should call us! Read on to learn a great strategy for asset protection, and call our asset protection law firm for a free consultation so that we may tailor an asset protection plan to your specific needs.

Charging Order Protection

Business entities have Limited Liability, which shields the owners from the liabilities of the business and inhibits creditor’s from collecting through personal assets. There are several different business entities you can form to get limited liability—but for optimal asset protection, you will want a business entity that wields what is known as “charging order protection,” such as a Limited Liability Company (LLC) or Limited Partnership (LP). Charging order protection means that a creditor can’t go after the assets of the LLC or its membership interests. Traditional corporations and single-member LLCs don’t have charging order protection, allowing creditors claim to the corporate shares or company interests. The purpose of charging order protection is to shield the non-debtor members or partners from being involuntarily forced into a membership or partnership with the debtor’s creditor, which is why single-member LLC’s and S-Corporations may not provide charging order protection. A judgment against a stockholder of a corporation can result in judicial foreclosure of the shareholder’s stock or may pierce the “corporate veil” so that the corporation’s assets can be reached to satisfy a creditor’s claim. For this reason, we recommend forming multi-member LLCs, which grant you limited liability and charging order protection.

Best Business Structure for Asset Protection

A popular Charging Order Protected Entity (COPE) is the Family Limited Partnership (FLP), a limited partnership where family members hold most if not all of the ownership interests—which is an important vehicle for asset protection and estate planning. After forming the FLP, all family assets can get transferred into it, including investments and business interests. After the transfers, a husband and wife (for example) will not own those assets individually, but rather hold a major interest within a business entity that owns those assets. The family members, being General Partners—will have complete management power and control over the affairs of the partnership and can buy or sell any assets they wish on behalf of the FLP. Furthermore, as General Partners, the family members can decide either to distribute the proceeds from the sale of the assets or to have the FLP keep such proceeds. Creditors cannot reach into the FLP and seize assets such as property, investments, bank accounts and other assets owned by the FLP. For this reason, a husband and wife that wisely transferred all their formal personal assets to the FLP, possess the interest in the FLP as their only individually owned asset.

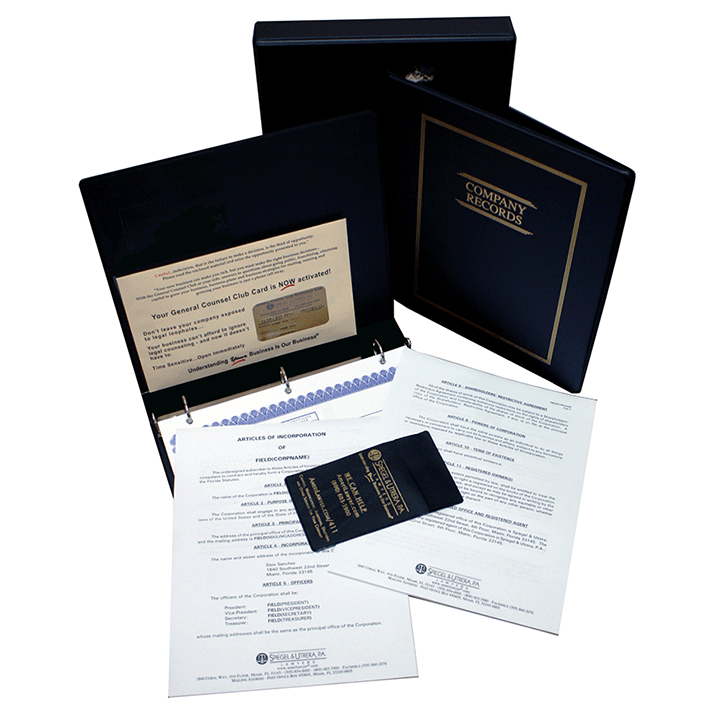

Each Family Limited Partnership is COMPLETE

INCLUDES State Filing Fee, “YES! Includes State Filing Fee”

INCLUDES Family Limited Partnership Seal and Book

INCLUDES Certificate of Limited Partnership

INCLUDES Family Limited Partnership Minutes

INCLUDES Family Limited Partnership Agreement

INCLUDES Preliminary Name Search

INCLUDES 110% Lowest Price Guarantee

(No Hidden Attorney Fees).

An Asset Protection Strategy

Let’s go over a strategy you can use to structure your asset protection plan. You may use layers of limited liability to isolate and protect your valuable assets. Individuals with appreciated property or assets should place each real estate parcel or business operation into its own Limited Liability Company. For anonymity, you may want land trusts (in the states that permit them). Furthermore, all of the operating LLCs should become owned by a Limited Partnership or Family Limited Partnership comprised of a General Partner that is a business entity with limited liability itself, such as an LLC (this would not be needed if you are in a state that permits Limited Liability Partnerships or Limited Liability Limited Partnerships), and several limited partners. The reason a Limited Partnership would be the holding entity is that compared to Limited Partnerships or Family Limited Partnerships, LLCs are a relatively new type of business entity that does not have the stability and predictability of settled case law. The initial owner should get Holding Limited Partnership interests, in proportion to the value of the real estate parcel or business operation contributed to the LLCs.

Following this strategy allows continuity of management and professional management, restriction of sales of Holding Limited Partnership interests, freedom from personal liability for contract, tort or hazardous waste claims regarding the real estate parcels or business operations, tax-free gifting to family or others to reduce taxable estate, participation of foreign investors, and minority discount valuation for estate tax purposes.

Spiegel & Utrera, P.A.’s Asset Protection Law Firm stands ready to help you structure your business entities for maximum asset protection. Click here to submit information about your individual situation and an attorney will contact you.